The Employee Retention Credit (ERC) is a CARES Act relief measure for businesses. ERC is a refundable credit for qualified wages. Whether your business applied and/or recieved PPP loans, you may still be eligible to claim the ERC credit. Eligible businesses can claim up to $5,000 per employee for 2020 and $7,000 per employee per quarter for 2021

To qualify for the ERC credit, a business must have incurred a decline in gross receipts or have a partial suspension of operations as declared by a governmental agency limiting commerce, travel or group meetings due to COVID-19. To meet the gross receipts decline test, a qualified business must demonstrate a decline in gross receipts from the corresponding prior year calendar quarter (i.e. Q4 2020 vs Q4 2019). For 2021, a business must demonstrate a reduction in gross receipts of at 20% when compared to the corresponding 2019 calendar quarter (i.e. Q1 2021 vs Q1 2019). 2020 quarters can be used for comparison if the business was not operational in 2019.

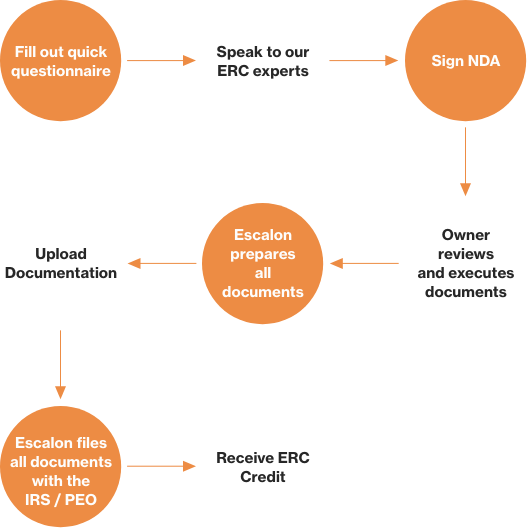

Provide basic business information to determine qualification and let us do the rest!

An organization into trade or business in 2020 and meets at least one of the below:

If you have not filed PPP forgiveness, you may want to check the amounts claimed. Please call us on (800) 956-8019 for clarity on this. (Further guidance awaited from the IRS)

2020: 50% of qualified wages up to $10K. Maximum credit per employee comes down to $5K. 2021: 70% of qualified wages up to $10K per quarter. Note: 2021 limit is for each calendar quarter and only applies to the first two calendar quarters ending June 30, 2021. For 2021, the maximum credit per employee comes down to $14K. 2021 ERC expires on June 30, 2021.

ERC credit is subject to income tax. Since wages on the claimed amount must be reduced by the amount of the credit, it becomes taxable income. Wage reduction can impact Section 199A, eligible wages for purposes of the 20% qualified business income deduction. For 2020 credit, when payroll taxes after the income tax return has been filed, an amended income tax return may be required to exclude wages reduced for ERC. Owners’ returns will also need to be amended for passthrough entities.

Firstly, you can earn a maximum $5K per employee for 2020 ERC. If you have a revenue decline of > 50% in any quarter, you will have a minimum of 6 months of 2020 in which you can earn ERC.

Consider which one applies to you?

If you are not clear, please give us a call at (800) 956-8019 and we will guide you further.

If you have 100 or less FTEs:

Consider what wages and health insurance benefits are eligible for the ERC. You may apply eligible expenses to the ERC by amending Form 941.

Consider what wages and health insurance benefits remain unreported. These may be eligible for ERC.

If you have more than 100 FTEs?

What points do you need to consider for eligible wages and benefits?

If you are not clear, please give us a call at (800) 956-8019 and we will guide you further. (Further guidance awaited from the IRS but we shall try to answer to the best of our knowledge)

For Partial or Full Suspension of Operations: Using period of full or partial shutdown. For Revenue Decline at least two quarters of wages can be claimed. For the entire initial quarter which first sustained the significant decline in gross receipts and for at least the following one quarter called subsequent quarter. If subsequent quarter’s revenues are > 80% of previous year, ERC would not be available for next quarter. Affiliation rules apply.

2020 ERC: quarterly revenue decline needs to be > 50%. (Compare your 2020 quarterly revenue with same quarter of 2019) 2021 ERC: quarterly revenue decline needs to be > 20%. (Compare your 2021 quarterly revenue with same quarter of 2019)

Special rule for ERC 2021 allows a comparison with the previous quarter to determine if revenue declines > 20%. e.g., For Q1 2021, Q4 2020 revenue could be used. (applies if Q1 2021 revenues did not decline > 20% from Q1 2019 revenues). If business started in 2019, the quarter of business inception is the base for determining decline (until business remains in operations for less than a year). e.g., A new business that started in Q2 2019 uses Q2 as base for Q1 2020 or Q2 2020. (if inception was in the middle of a quarter, an estimate period’s gross receipts may be used).

For “small employers,” ERC can be claimed on all employee wages.

If not a small employer, ERC can only be claimed on wages paid while they were not working.

For defining employees “not working” please get professional advice.

Wages paid to certain related parties and owners are limited. Family members such as siblings, children, parents, grandparents etc. are ineligible. (under rules similar to Section 51(i))

IRS FAQ #59 defines ineligible relationships as:

Ineligible wages also include wages paid to an employee with an ineligible relationship (described in the link above) to someone considered to indirectly own 50% or more of the business through a constructive ownership (under §267(c)). Spouses, brothers, sisters, ancestors and descendants are considered to have indirect ownership. Indirect ownership can also occur from ownership in other business entities such as corporations, partnerships and trusts.

Additionally, self-employment earnings of self-employed individuals are not considered qualified wages.

For 2020 ERC, employers with 100 or less full-time equivalents. However, for 2021 ERC, it is 500 or less. Reference period is 2019 employment for both. Affiliation rules to be considered for computing FTEs (Section 4980H enacted in 2010 as part of the Affordable Care Act (ACA)). “A full-time employee for any calendar month is an employee, who has on average at least 30 hours of service per week during the calendar month or at least 130 hours of service during that month”

Gross wages + employer health insurance costs. Maximum qualified wages are $10K per annum per employee for 2020 and $10K per quarter, per employee for 2021. (Previously under the CARES Act, if you obtained a PPP loan, you could not benefit from the ERC, however, this rule changed retroactively. Though, wages claimed on the PPP loan cannot be claimed for ERC (similar is the case for wages claimed for emergency paid sick leave and emergency paid family and medical leave under FFCRA).

Wages and health insurance benefits claimed for ERC cannot be claimed towards certain other credits.

Kindly refer:

ERC is a payroll tax credit and is reflected on Form 941.Calculate ERC by computing ERC for a pay period and adjust the required tax deposit downward by the credit amount. Prior to filing Form 941, if you can have an ERC in excess of your required deposit, you can request an advance by filing Advance Credit Form, 7200. (Special provision under CARES act: Penalties for failure to make a deposit of employment taxes will be waived if employer is determined to have a reasonable expectation of employee retention credit)

If eligibility is determined after the quarter-end but prior to filing Form 941, credit may be claimed on the form as per Form 941 instructions.

(ERC is reported on line 11c of Form 941 and, if applicable, line 13d. Qualified wages (excluding health expenses) are reported on line 21. Eligible ERC wages are reported on line 5a (Social Security wages) and line 5c (Medicare wages).

Health care expenses are reported on line 22) Note: For 2021, employers with 500 or fewer FTEs can claim an advance credit based on 70% of the average quarterly wages for 2019. (Further guidance awaited from the IRS)

It can be claimed on Q4 payroll tax return even if the qualified wages were paid from January 1, 2020 to September 30, 2020. (Further guidance awaited from the IRS). As an alternative, you can file it on Form 941-X. (lines 18, 26, 30, and 31 are impacted)

We handle your essential business services so you can focus on growth. Schedule a call to discuss your company’s unique needs or drop a line at connect@escalon.services