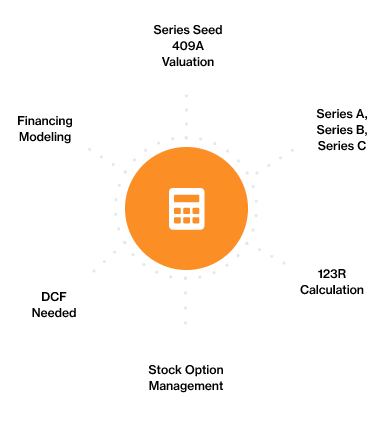

When you issue stock or stock options to employees or yourself, they need to be valued at “Fair Market Value” (FMV) or you may be creating compensation and income. And when there’s income, there’s taxes.

Having a third party determine your company’s fair market value through a 409A valuation provides a “safe harbor” that can help ease or eliminate the tax burden.

Stock options are the most common case of 409A valuation. But there are situations where it’s required. How do you know if you need one?

Quick turnaround

AICPA compliant

Audit support

Common stock fair market value

The bottom line is I would have been even willing to pay a little more because now that I realized the confidence I have in the accounting procedures and in the accuracy of data I’m receiving. This is just worth its weight in gold really.

Frank LaGrotteria, Bridgeport International Academy Director & Head Master

2000+ valuations

15+ years of experience

$378 capital raised

$3B cash managed